The Blog

Navigating the Bank of Canada's Interest Rate Increase

In a recent announcement, the Bank of Canada revealed an increase in interest rates by 0.25%. As a realtor, it's my responsibility to keep you informed about market changes that can affect your financial decisions. In this blog post, we'll dive into what this interest rate hike means for homeowners and buyers, offering valuable insights and guidance to help you navigate the shifting real estate landscape.

The Bank of Canada has raised the interest rate by 0.25%!

The Canadian housing market has been a topic of significant interest and discussion, and recent developments have brought even more attention to it. The Bank of Canada has announced a 0.25% increase in the interest rate, prompting concerns and speculations about its potential effects on the housing market. In this blog post, we will delve into the implications of this interest rate hike, shedding light on its impact on fixed rates, market sentiment, and the prevalent "fear of missing out" phenomenon.

What's Happening in Toronto Real Estate - February 2023

Toronto's Real Estate Market - January 2023

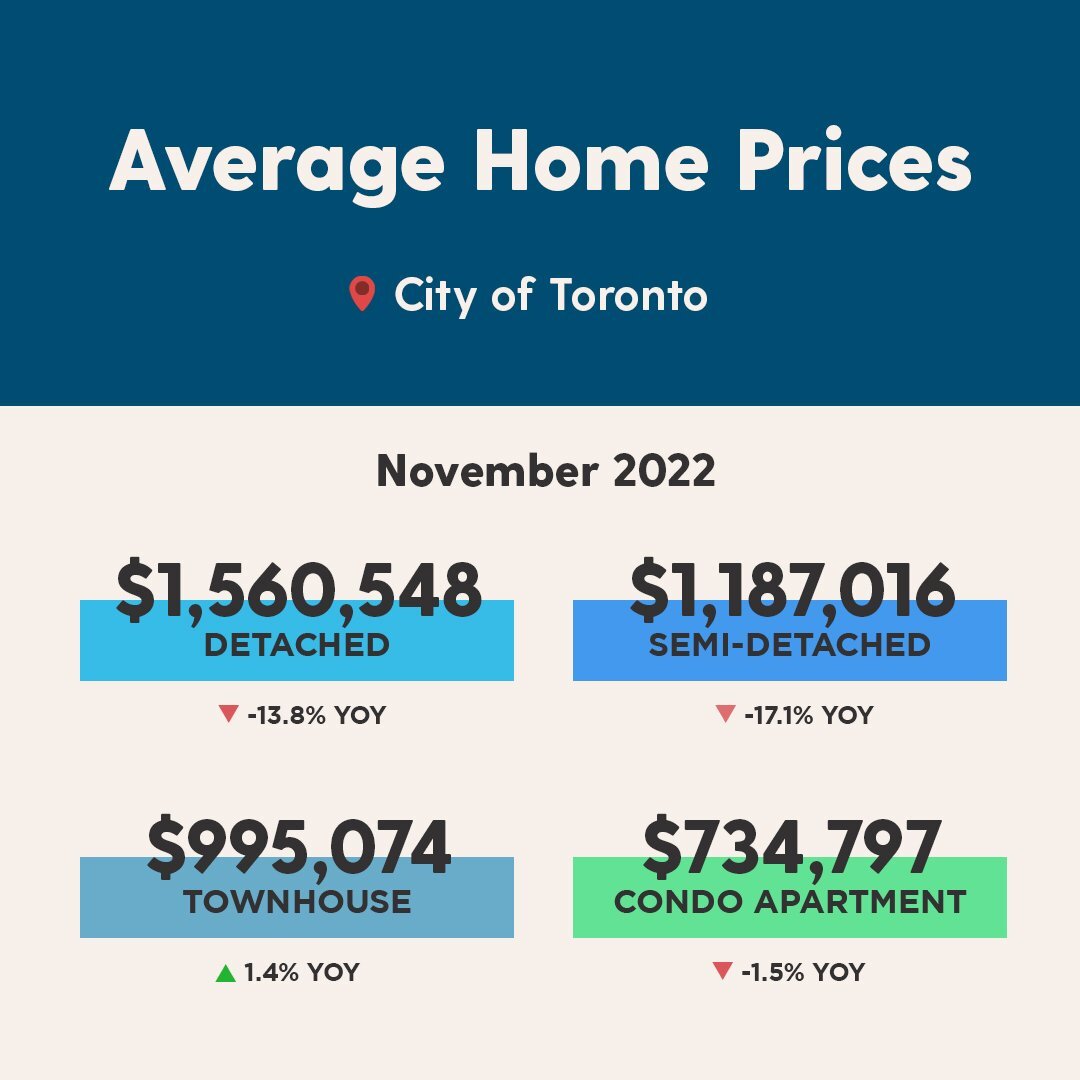

Market Watch - November 2022

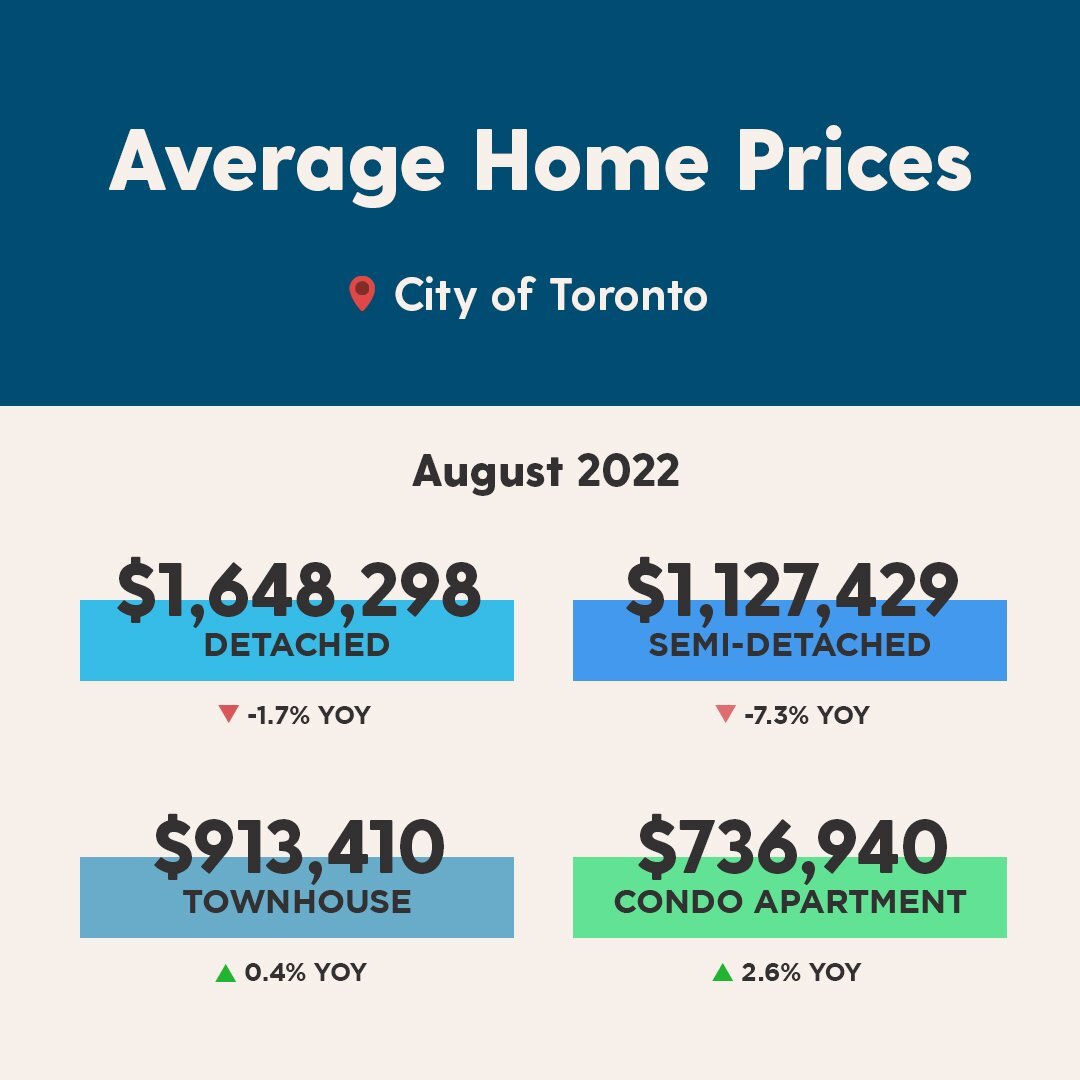

Market Watch - August 2022

How A Toronto Real Estate Agent Determines Price

Double Checking The Details Before Renting

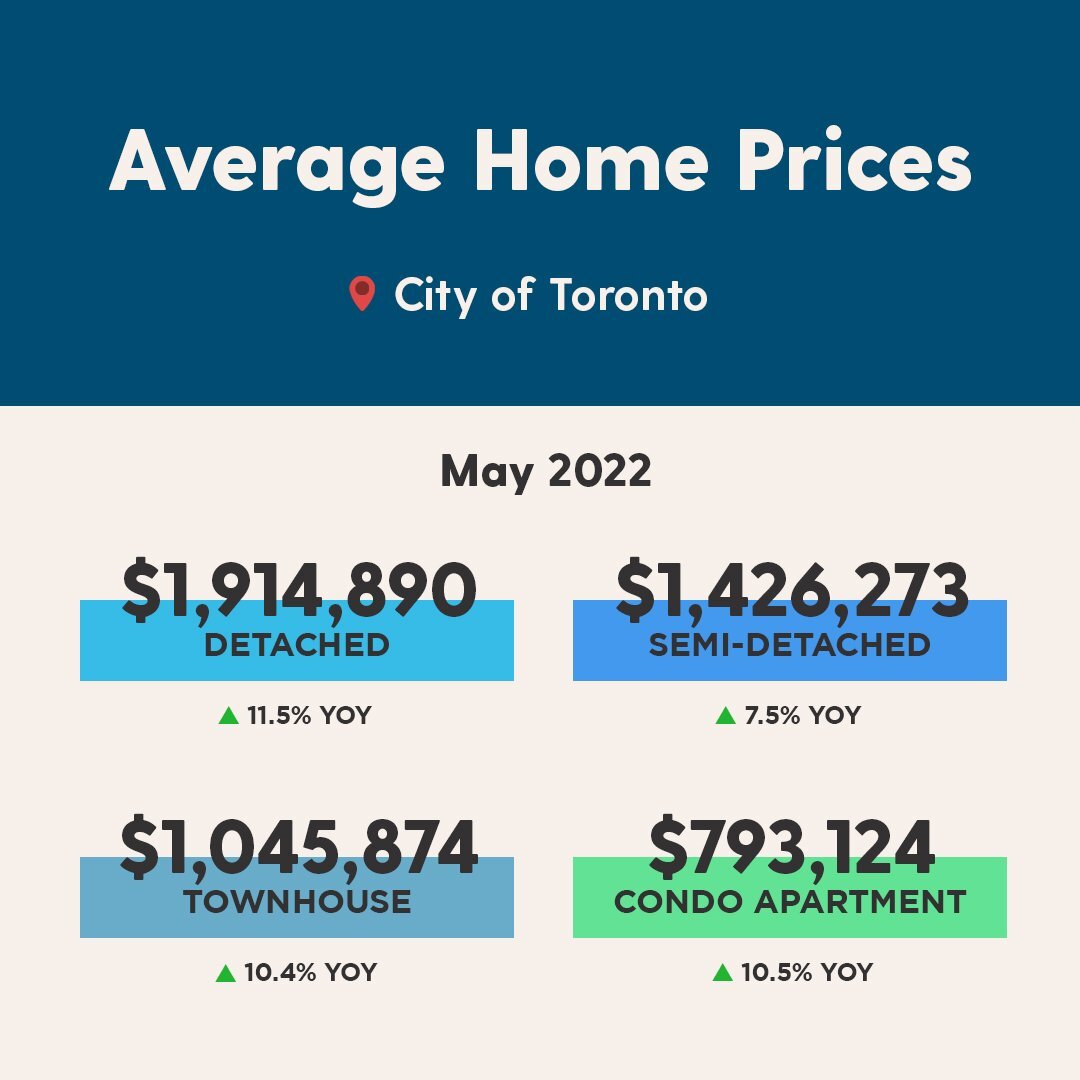

Market Watch - May 2022