The Blog

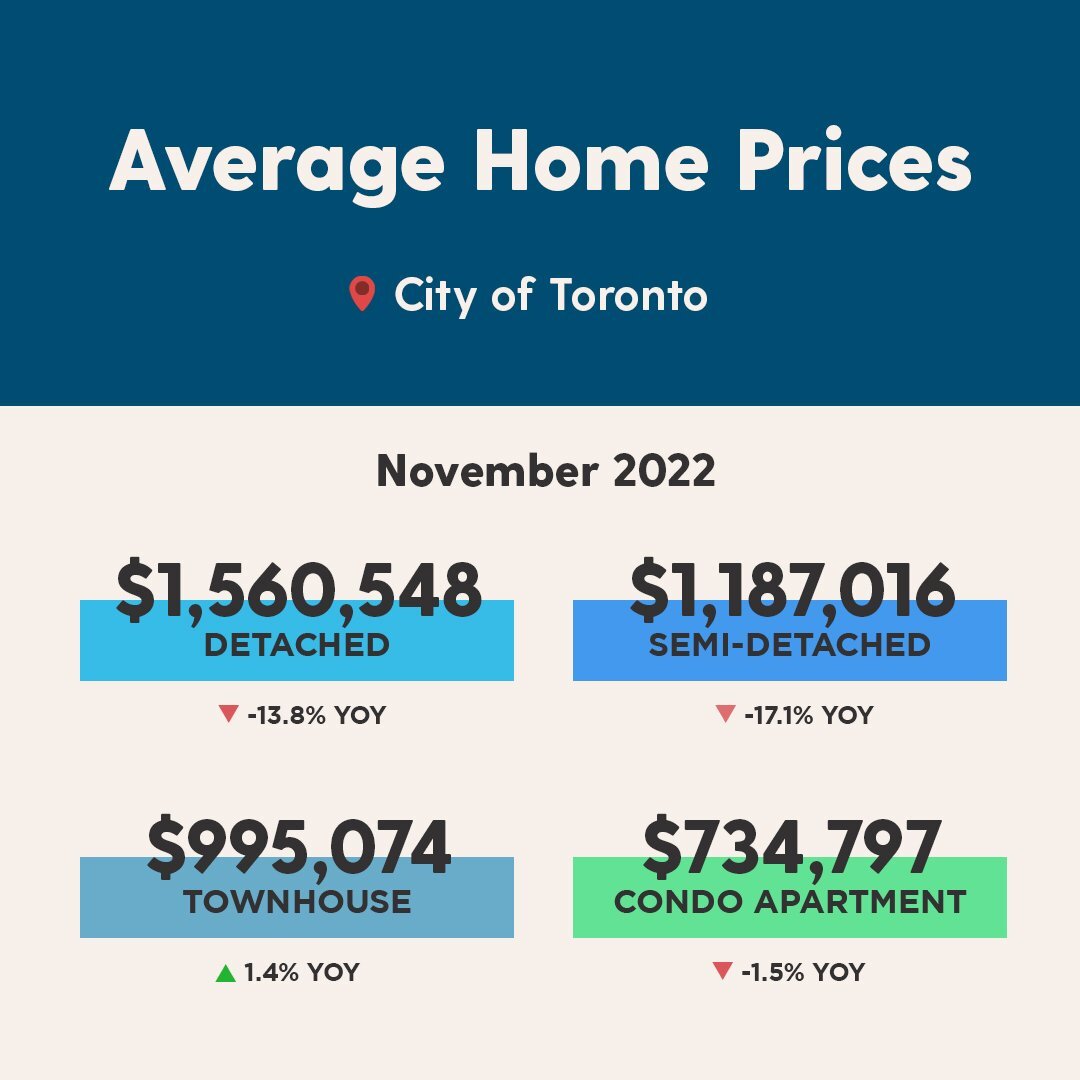

Market Watch - November 2022

Double Checking The Details Before Renting

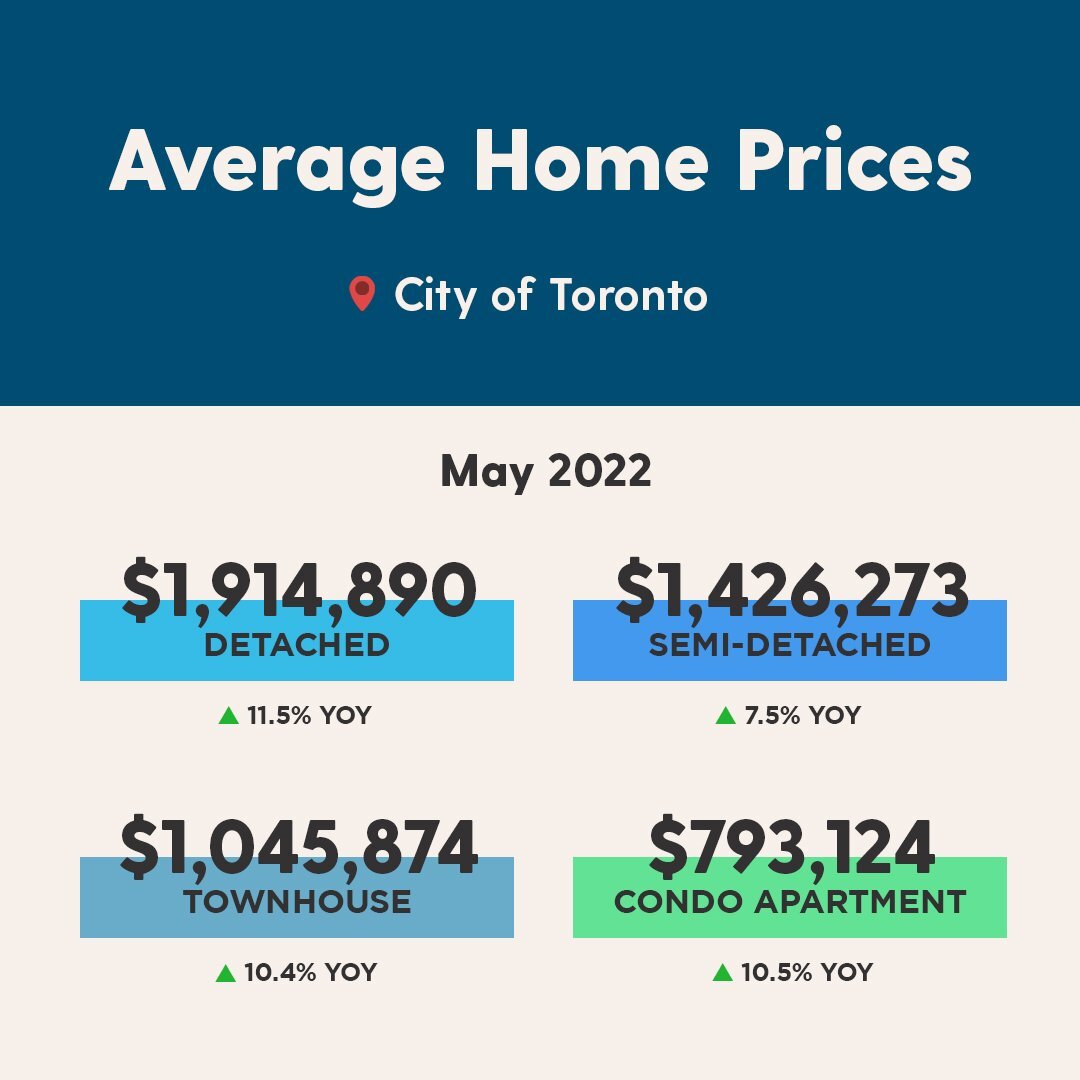

Market Watch - May 2022

Securing Your Beloved Home

Rent Easy With a Fair Price

4 Tips for Your Next Big Move

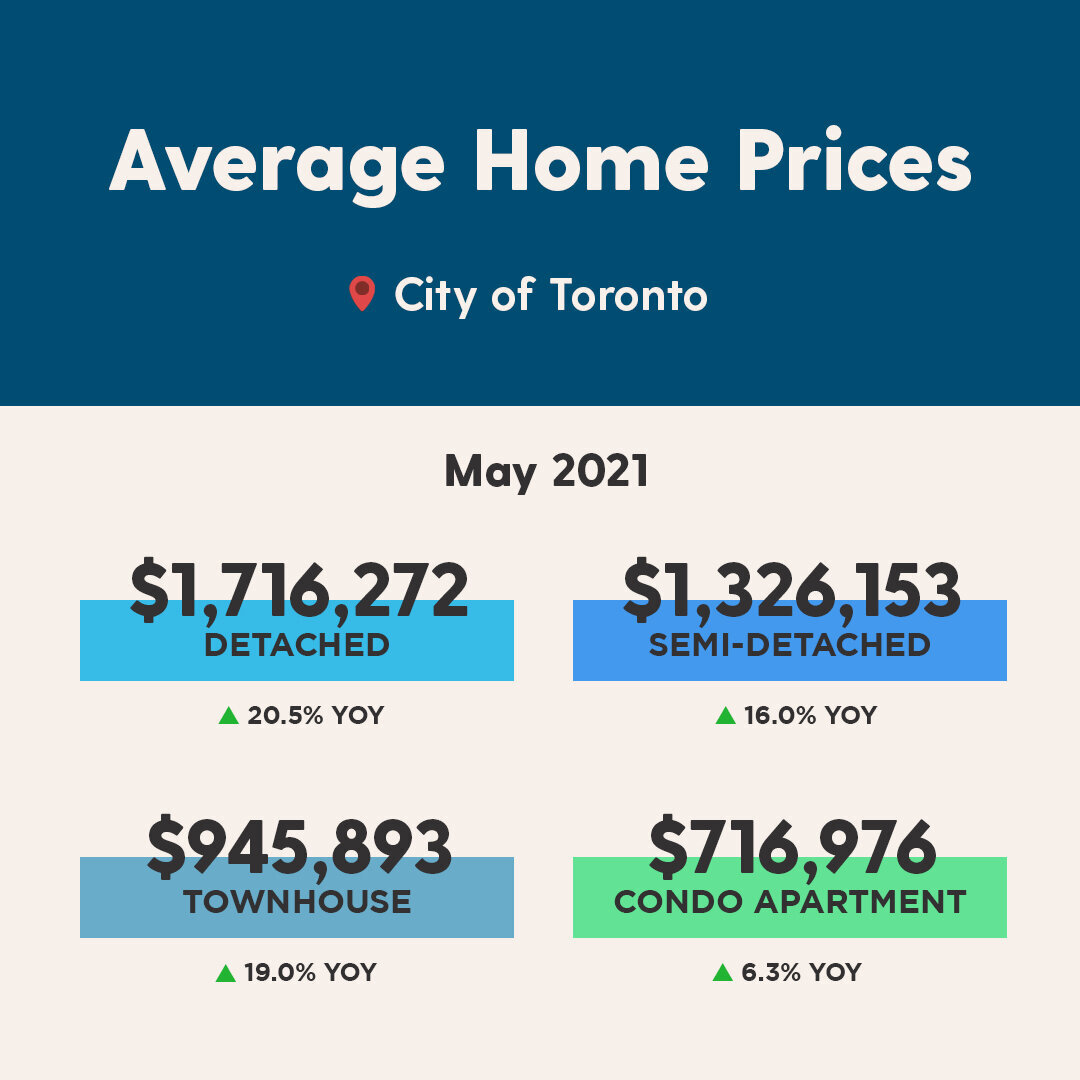

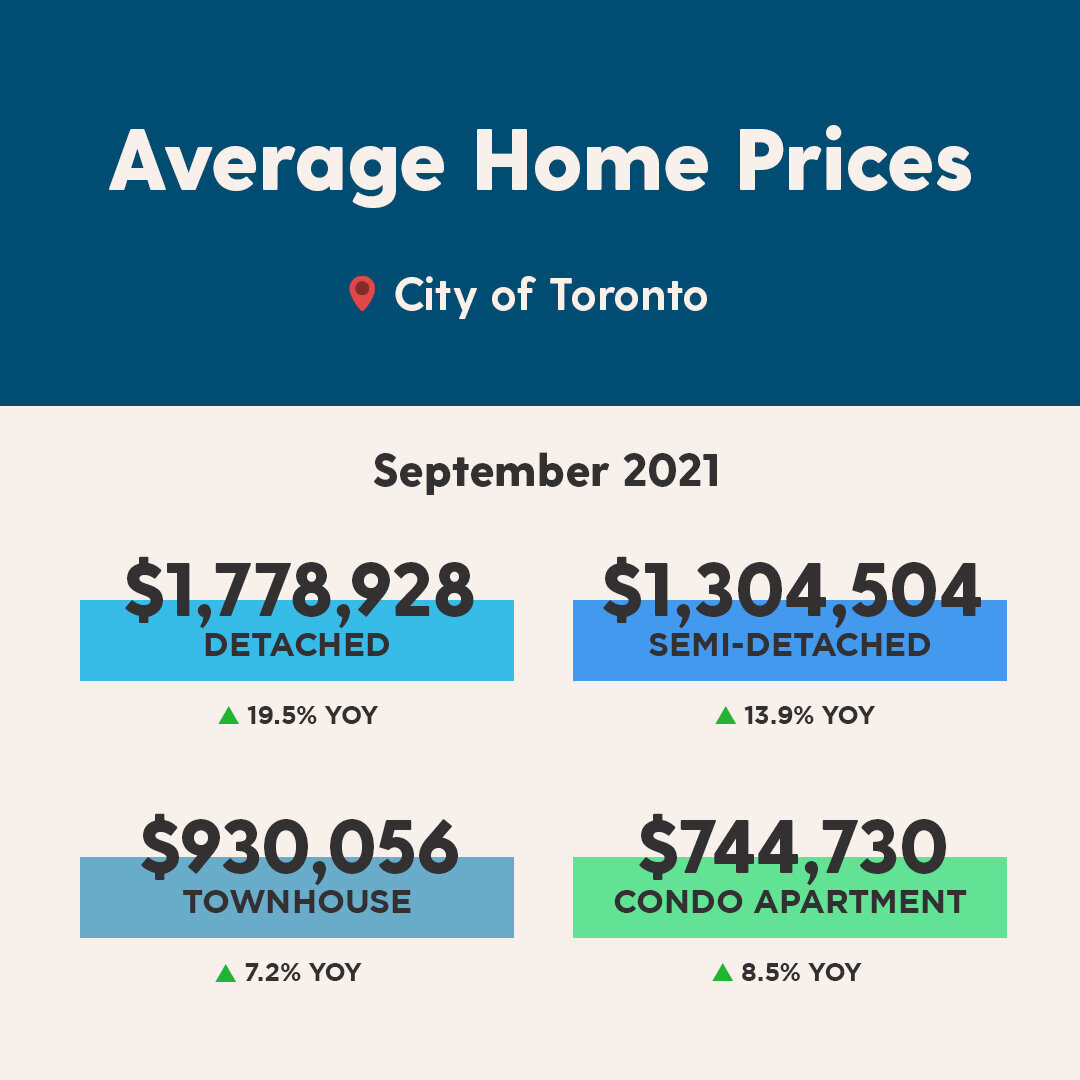

Market Watch - September 2021

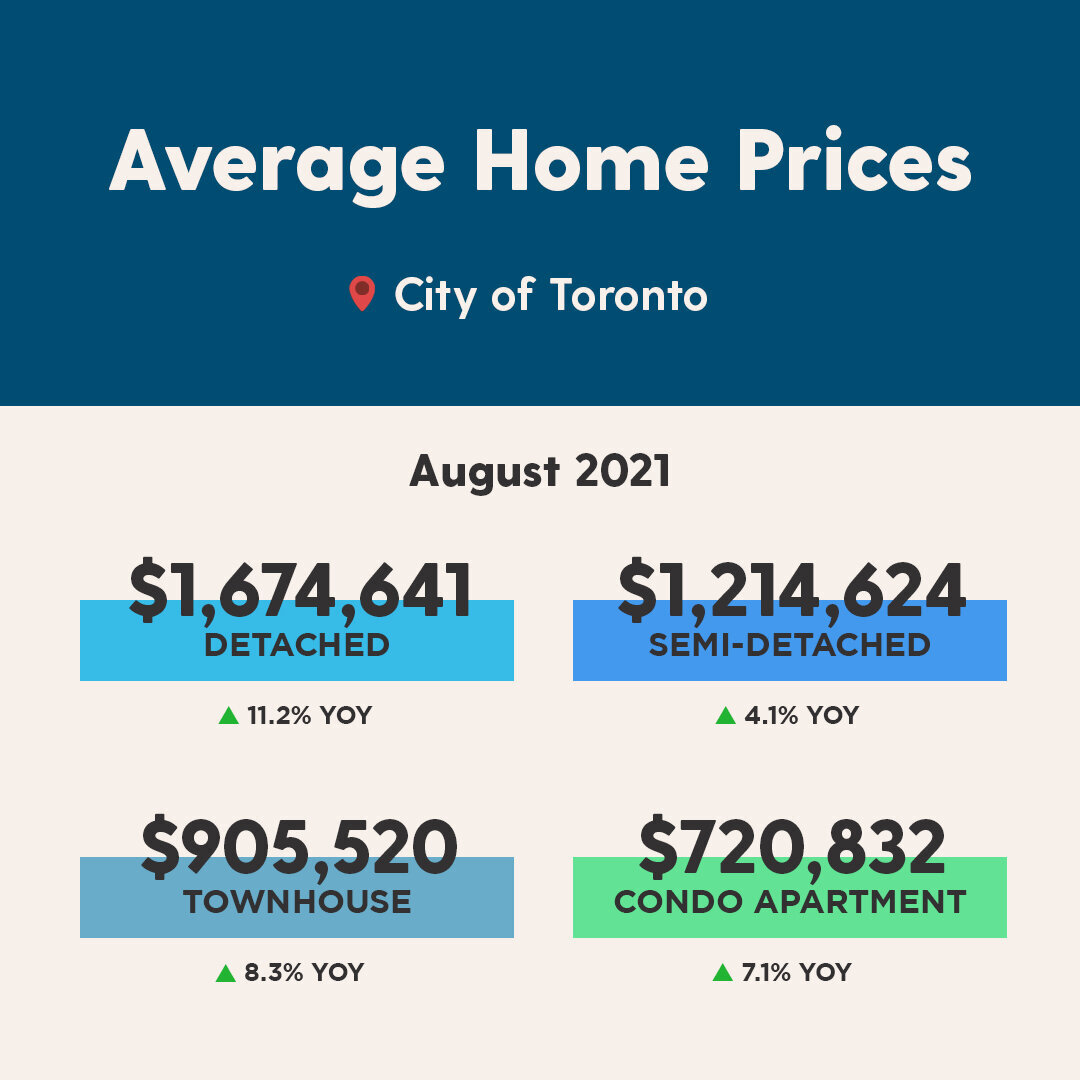

Market Watch - August 2021

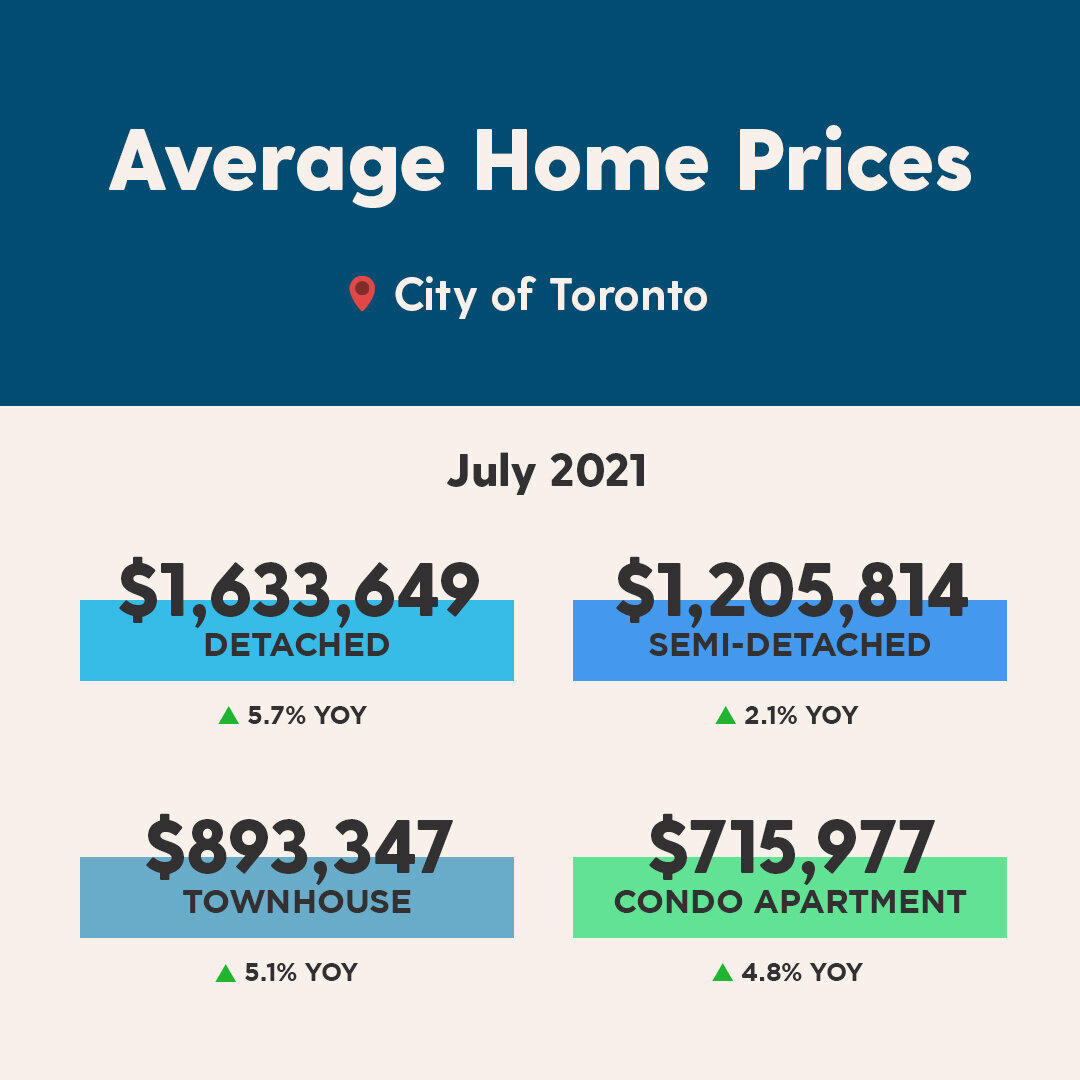

Market Watch - July 2021