The Blog

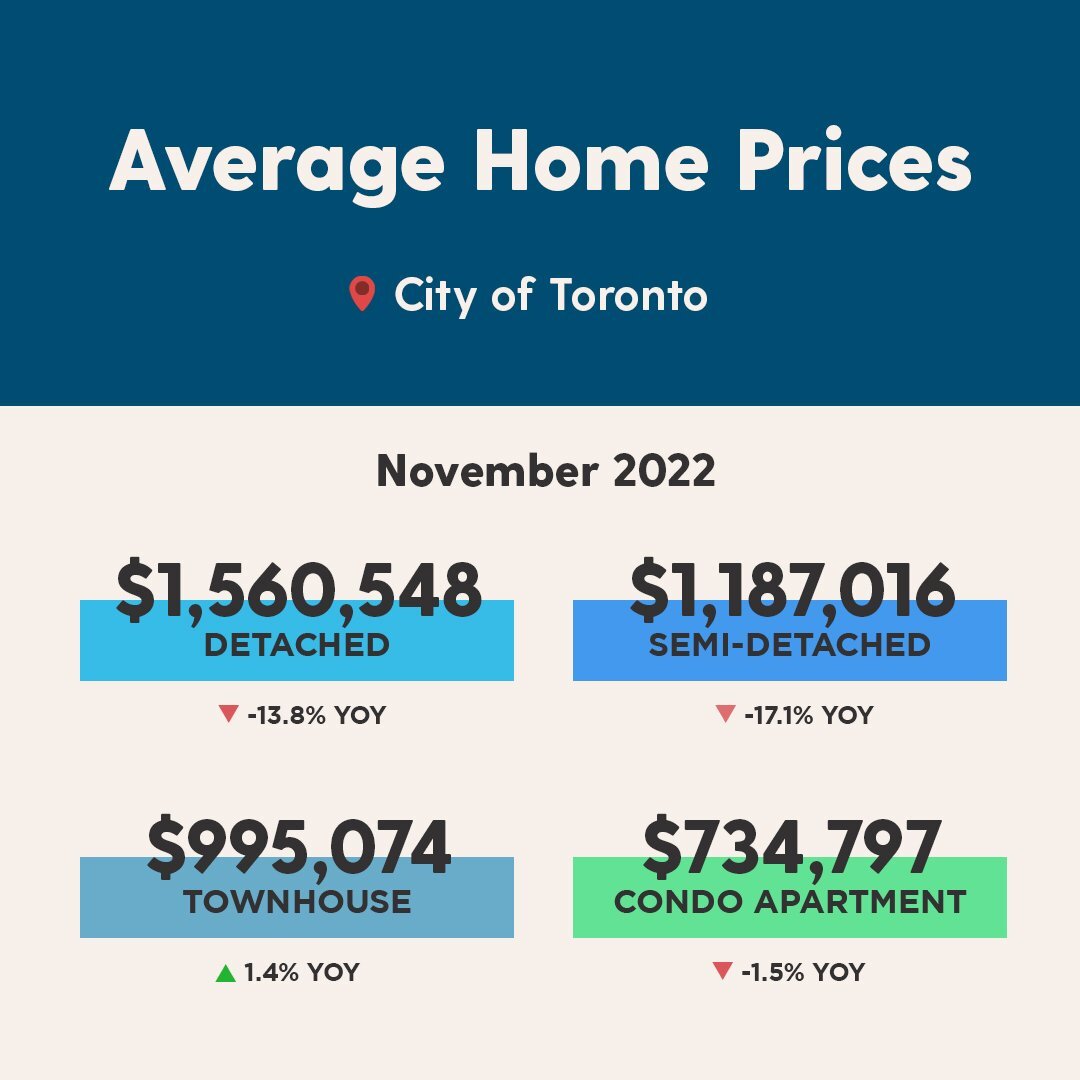

Market Watch - November 2022

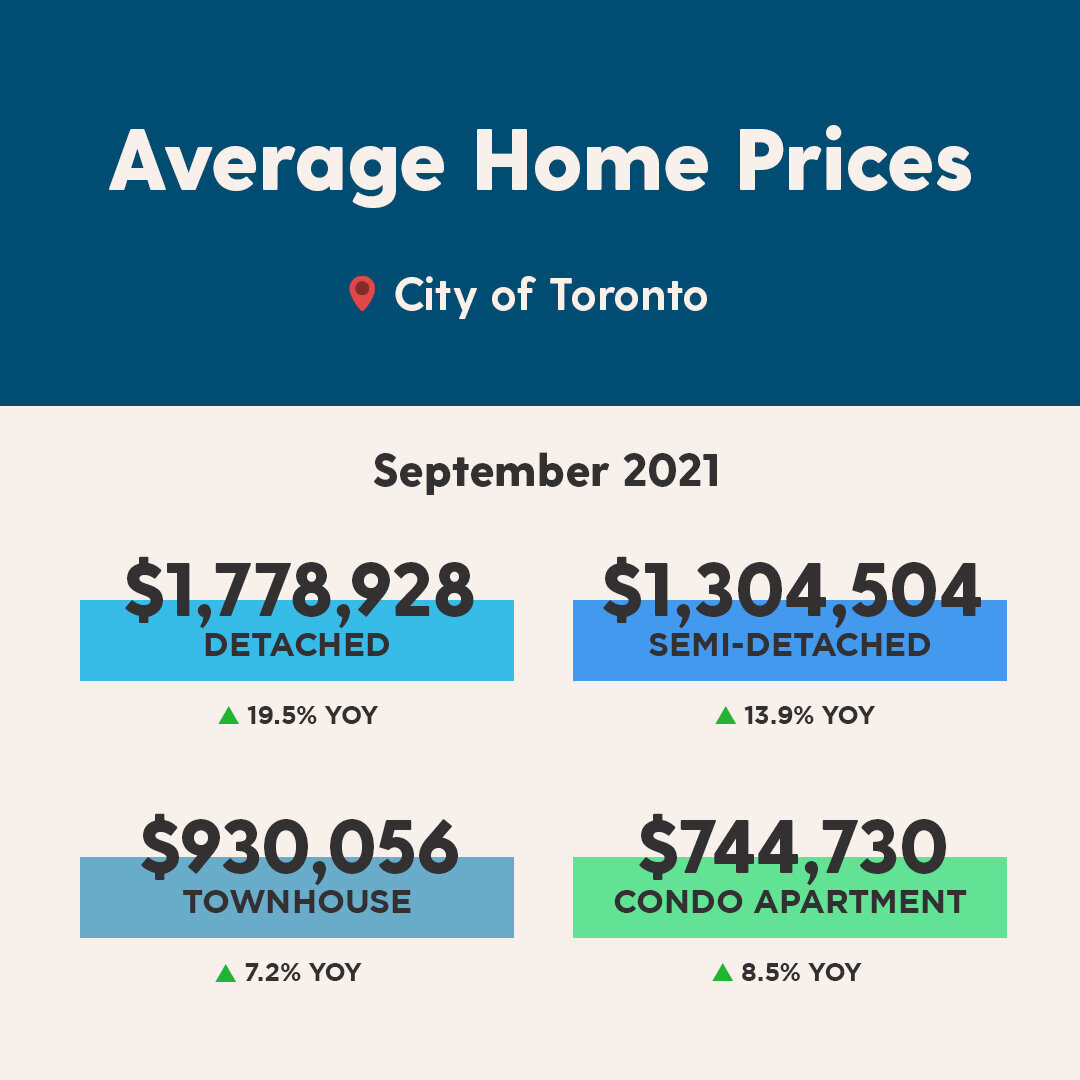

Market Watch - September 2021

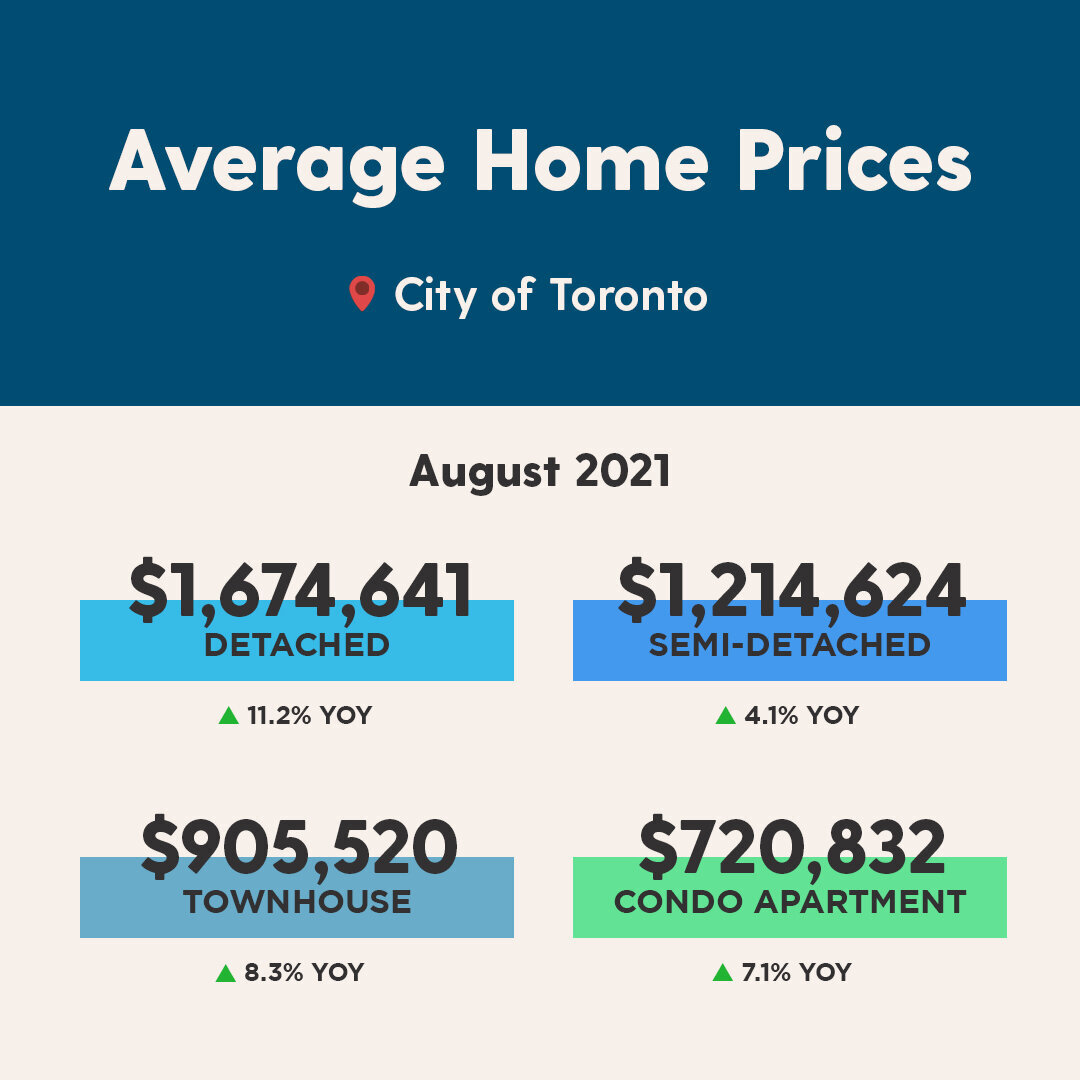

Market Watch - August 2021

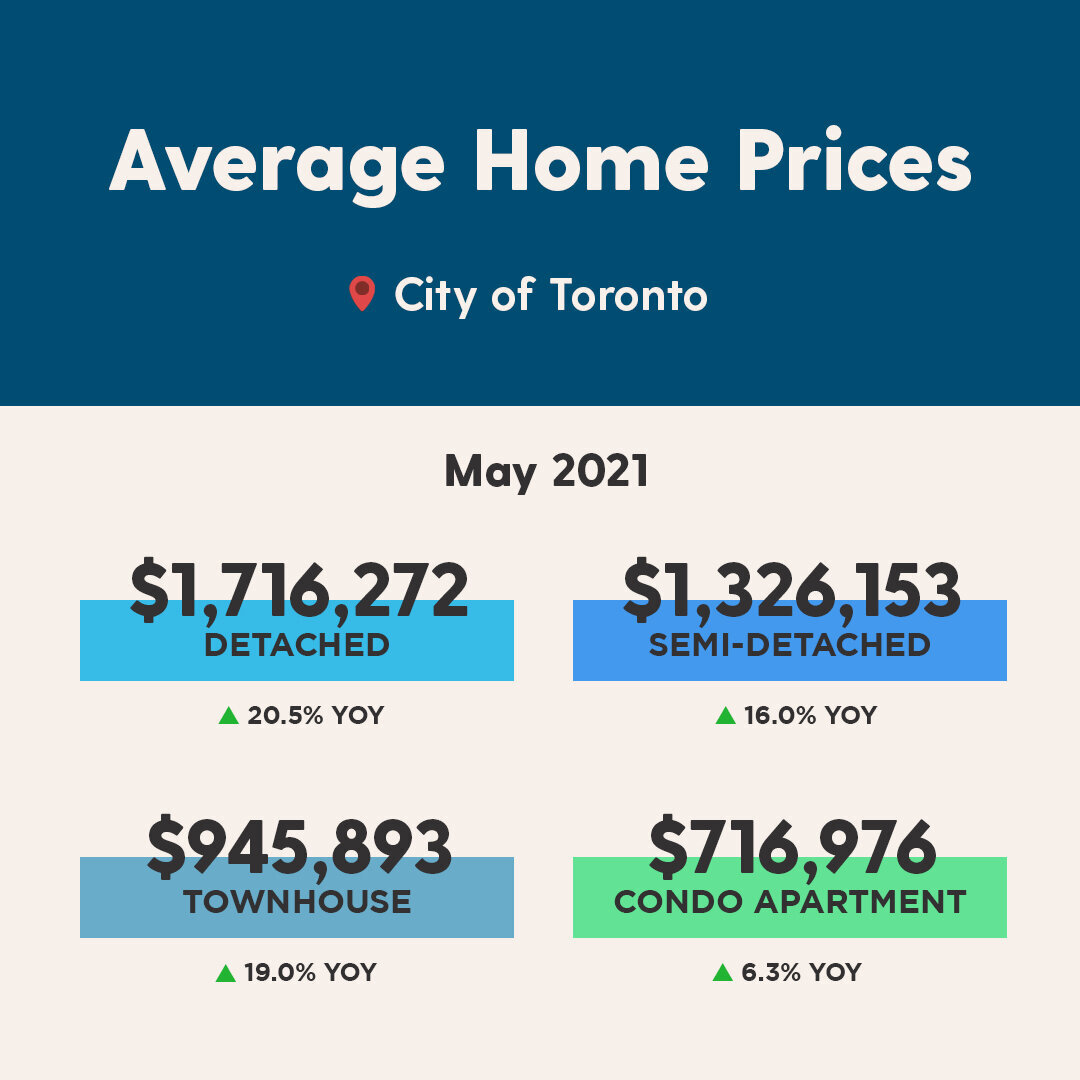

Market Watch - May 2021

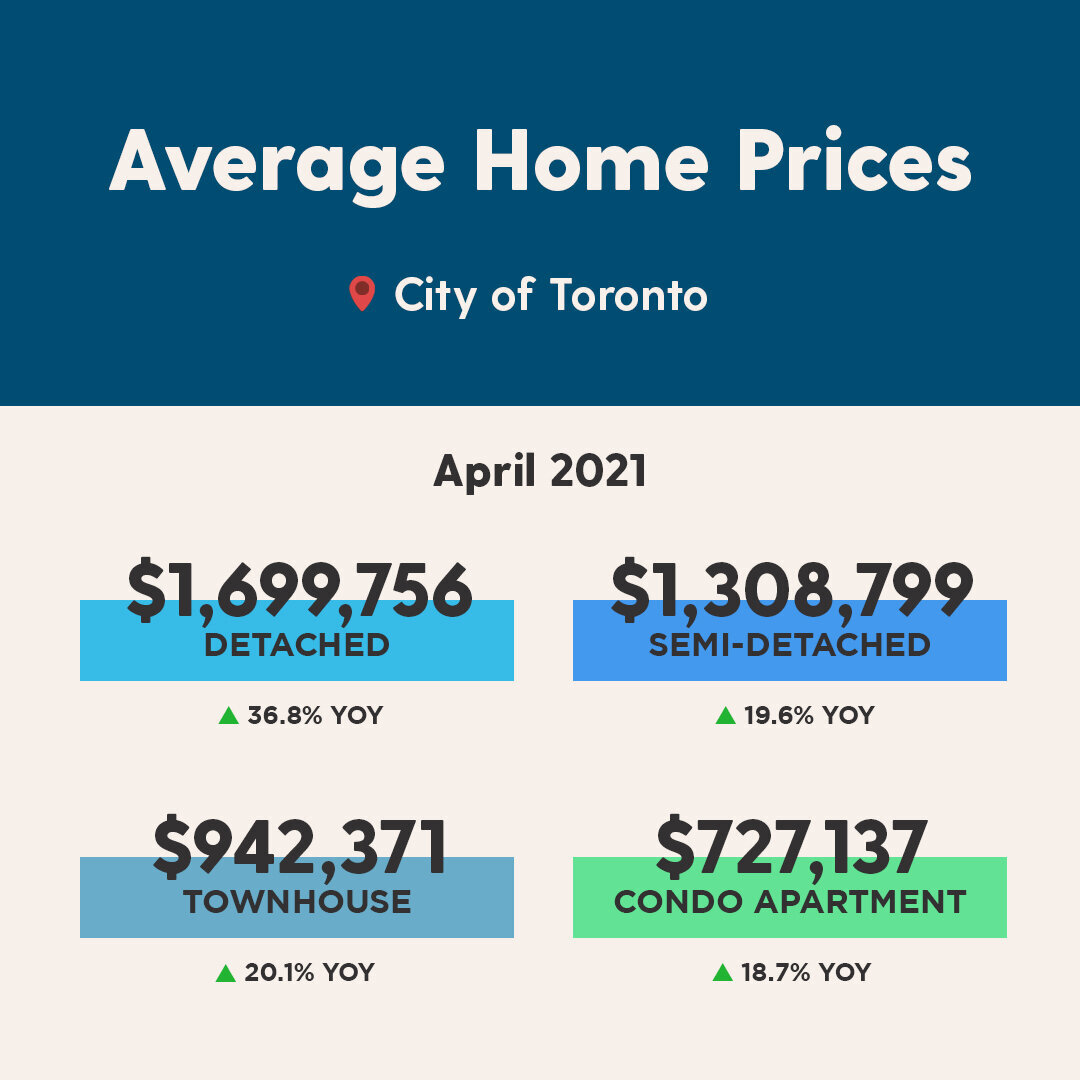

Market Watch - April 2021

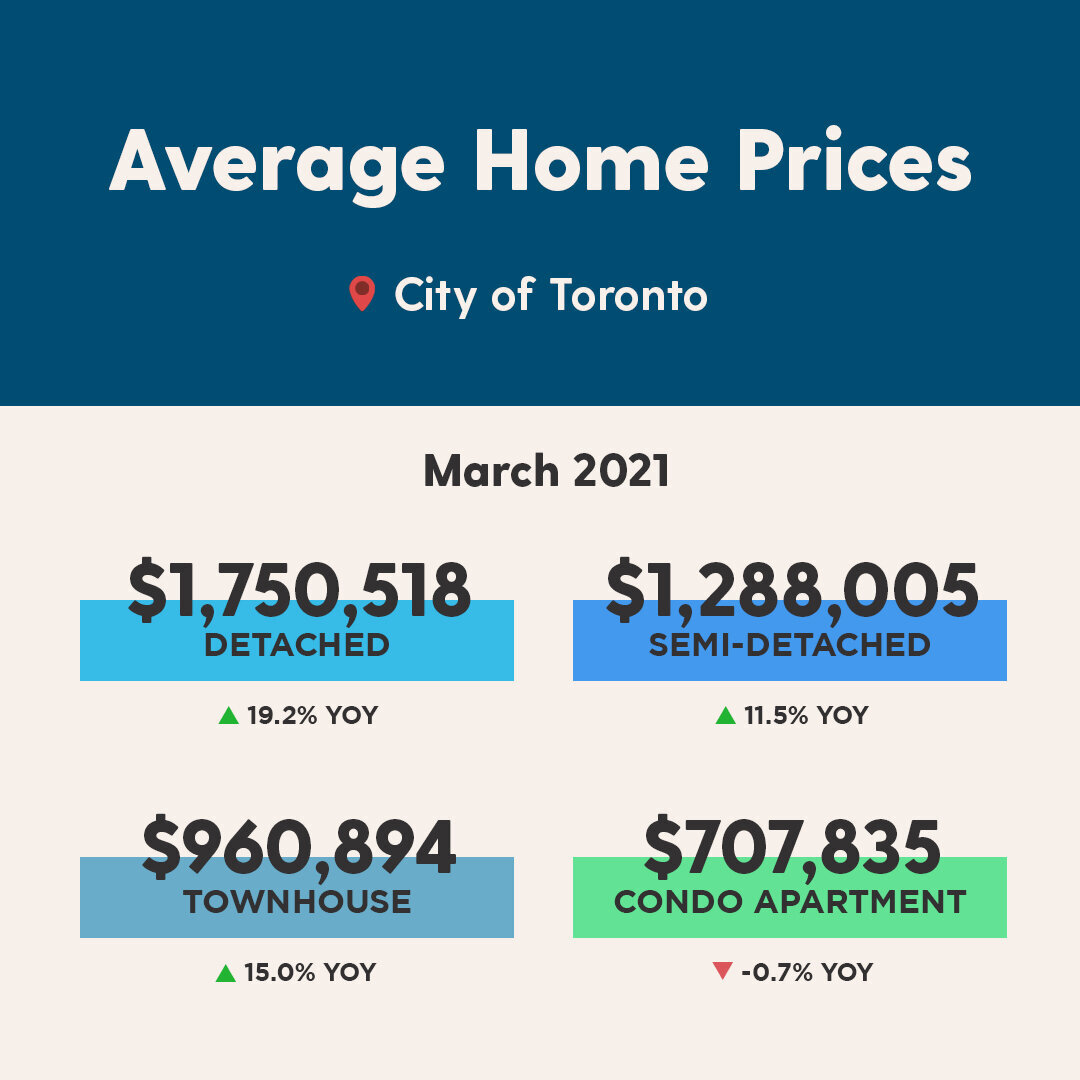

Market Watch - March 2021

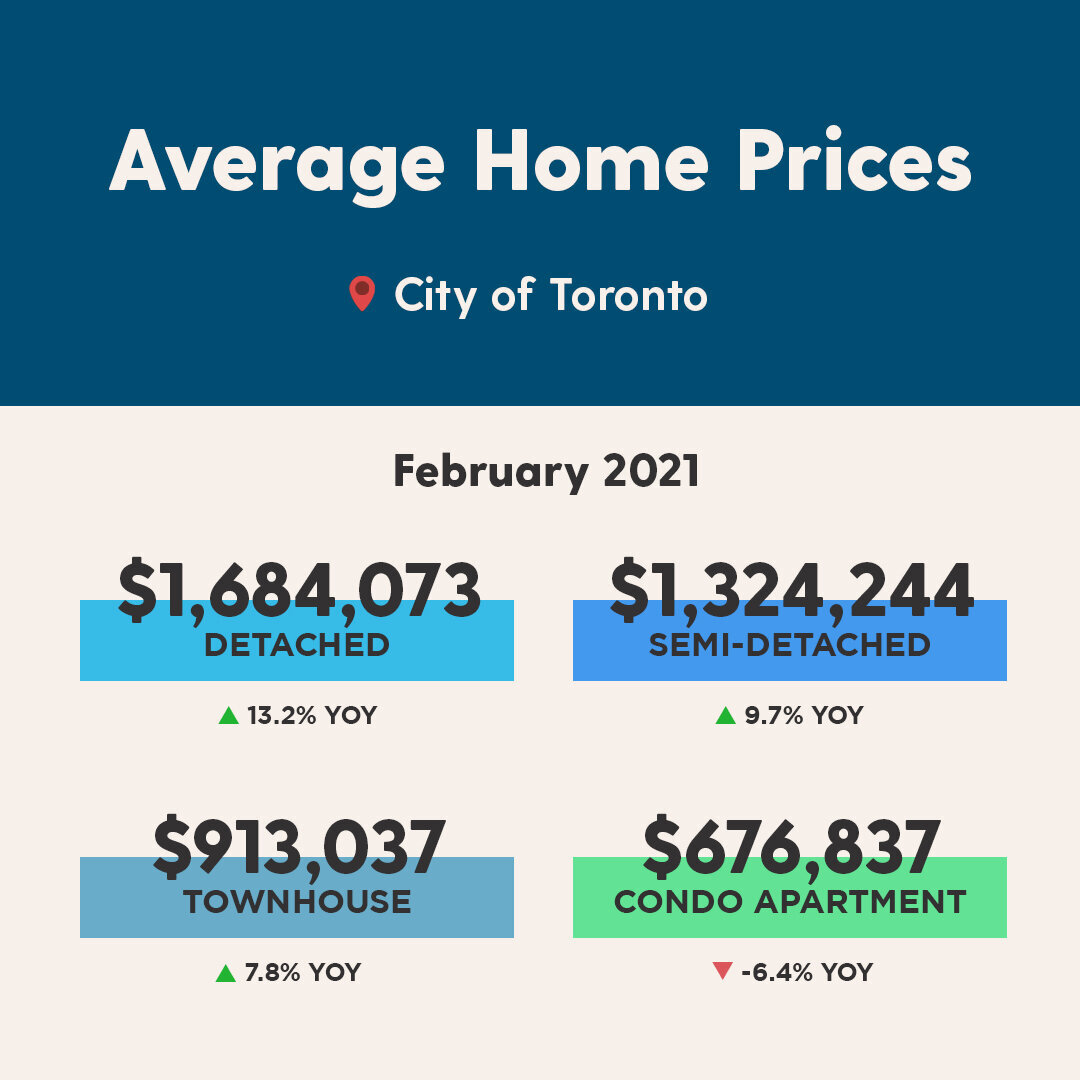

Market Watch - February 2021

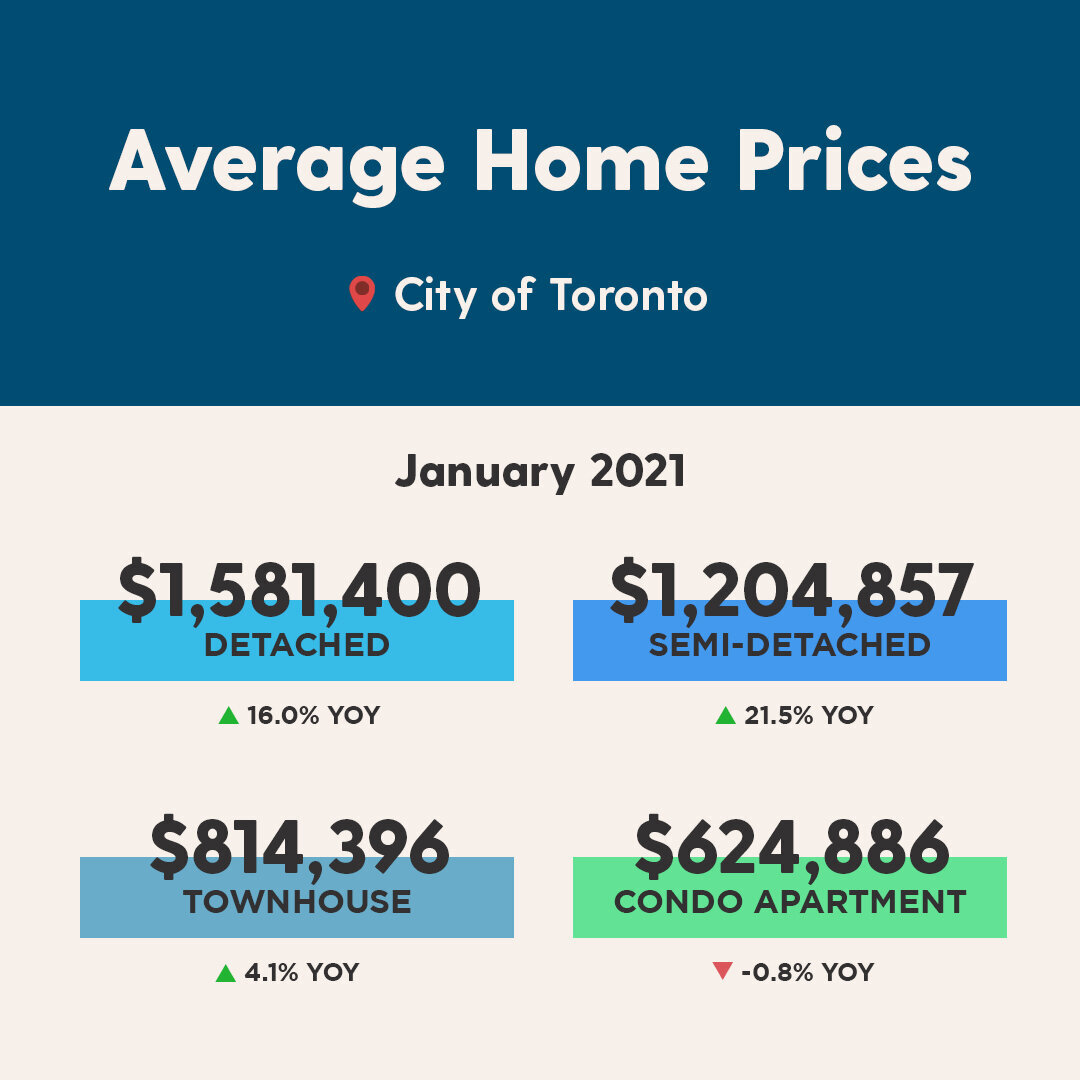

Market Watch - January 2020

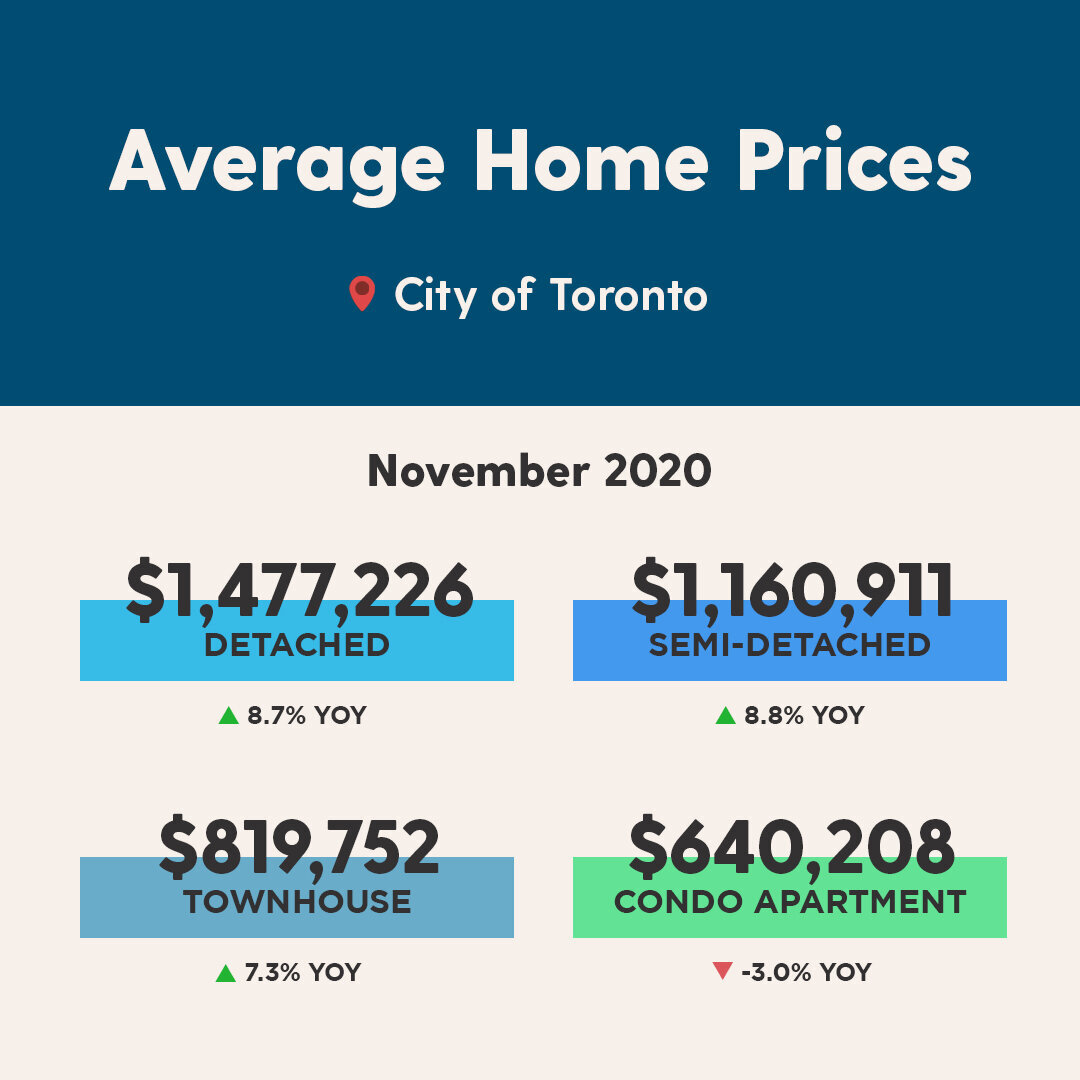

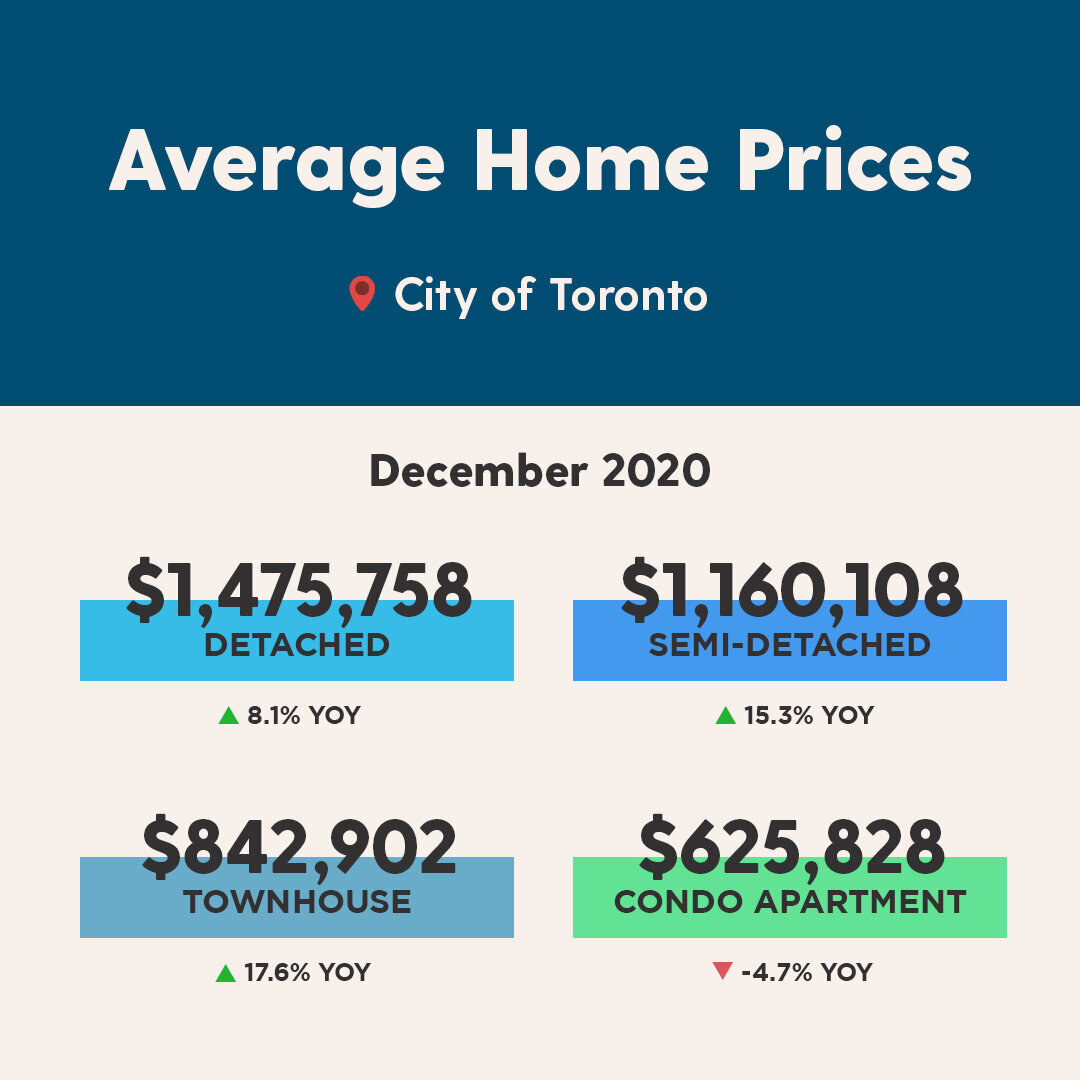

Market Watch - December 2020